Article: How to Keep RFID Credit Cards Safe to protect your cards from scanners and Are RFID-Blocking Wallets Necessary to Prevent Credit Card Theft?

How to Keep RFID Credit Cards Safe to protect your cards from scanners and Are RFID-Blocking Wallets Necessary to Prevent Credit Card Theft?

How RFID protect credit cards and make transaction easier and secure

RFID technology significantly enhances the security and convenience of credit card transactions. This article will explore what RFID is, how it works, its advantages for payment processing, its security features, and considerations for users in ensuring safe and secure transactions.

Understanding RFID Technology

RFID, which stands for Radio Frequency Identification, is a technology that employs radio waves to transfer information between a tag attached to an object and a reader. In the context of credit cards, RFID technology enables contactless payments, allowing cardholders to make transactions simply by tapping or waving their cards near a payment terminal. This innovation has grown increasingly popular due to the convenience it offers, especially during a time when minimizing physical contact has become paramount for safety.

RFID credit cards are equipped with microchips and antennas that communicate with readers through electromagnetic fields. When a cardholder brings their RFID-enabled card within a very close range (typically 1 to 2 inches) of a compatible reader, a secure connection is established, allowing for the swift exchange of information necessary to complete a transaction.

The adoption of RFID in credit cards not only streamlines payment processes but also enhances their usability in various retail environments, offering a frictionless experience that traditional magnetic stripe cards cannot match.

How RFID Works in Transactions

When a cardholder initiates a transaction with an RFID credit card, the process is remarkably straightforward. The card reader emits radio waves, which activate the RFID chip within the card. The chip then transmits a unique transaction code to the reader. This code is valid for a single transaction only, further enhancing security by ensuring that the same code cannot be used multiple timescitation.

This method of tokenization, where sensitive information is replaced by a random token, ensures that even if a hacker were to intercept the signal, the data obtained would be nearly useless without the specific context of the transaction. Moreover, the encryption involved in this process adds an additional layer of protection, safeguarding customer data from unauthorized access.

RFID technology also minimizes the time taken for transactions, reducing wait times for customers at checkout counters. With the rise of contactless payments, many retailers have adjusted their systems to accommodate RFID technology, thus enhancing overall customer satisfactioncitation.

Benefits of RFID Credit Cards

The integration of RFID technology into credit cards offers numerous advantages that enhance both security and convenience for users. These benefits include:

Convenience: RFID credit cards allow for quick and easy transactions. Users can simply hold their card near a terminal, eliminating the need to swipe, insert, or even enter a pin for certain transactions below a specified limit.

Speed: Transactions using RFID technology can be completed in a fraction of the time it takes to process traditional card transactions. This efficiency is particularly advantageous in busy retail environments, reducing checkout lines and improving customer flow.

Hygiene: Amid growing concerns about germs and bacteria, contactless payments enable users to avoid touching potentially contaminated surfaces, such as readers.

Enhanced Security: RFID technology creates a more secure payment environment. Each transaction generates a unique code that is only valid for that transaction, reducing the risk of information theft and fraud.

User-Friendly Design: RFID-enabled cards often come with designated symbols indicating their functionality. This design feature makes it easier for consumers to identify and use their cards effectively.

Security Features of RFID Technology

While the convenience of RFID credit cards is evident, their security features warrant attention as well. Several aspects make RFID technology robust against fraud and unauthorized access.

One-Time Transaction Codes: Unlike traditional credit cards that transmit static information, RFID cards generate new codes for every transaction. This mechanism means that even if a thief intercepts a code, it cannot be reused, significantly thwarting fraud attempts.

Encryption: Data transmitted via RFID is encrypted, making it challenging for unauthorized parties to access sensitive information. The complexities of encryption methods ensure that even if intercepted, the data remains secure and unusablecitationSourceInde.

Limited Range: RFID systems operate effectively only within a limited distance. This limitation means that thieves using RFID scanners would have to be extremely close to their targets, often making such thefts impractical in public settings.

Low Incidence of Fraud: Official reports indicate that instances of theft related to RFID credit cards are relatively rare, further highlighting the effective security measures in place.

Mitigating RFID Security Risks

Despite the inherent security advantages of RFID credit cards, users should still take proactive measures to ensure their information remains protected. Here are several strategies to enhance RFID card security:

Understanding Usage: Familiarize yourself with where and how to use your RFID card. Avoid using your card in crowded places where someone might use a scanner to collect data stealthily.

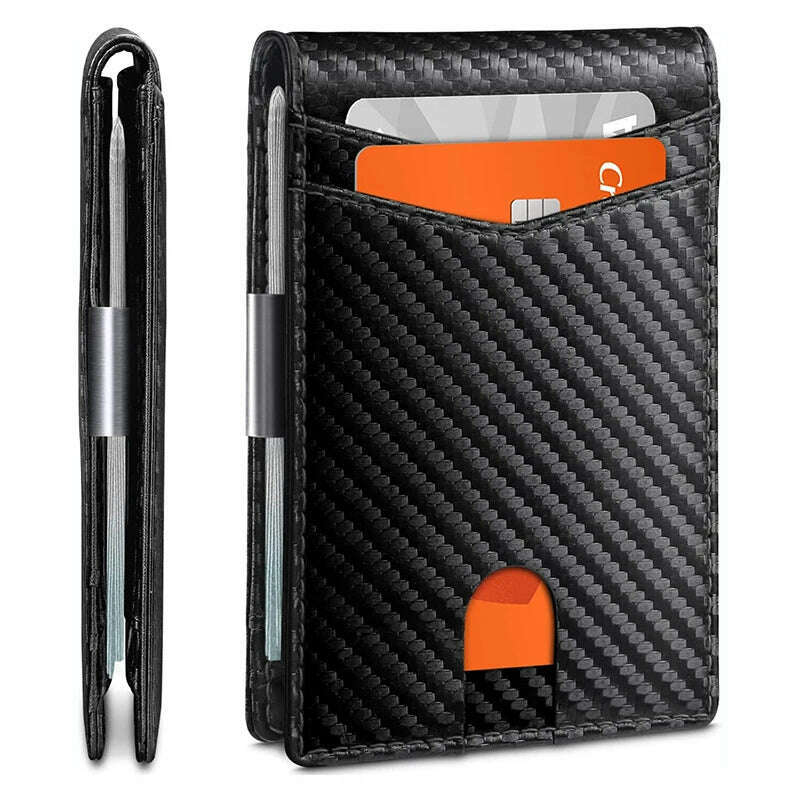

Opting for RFID-Blocking Products: While most interactions happen at very close ranges, investing in RFID-blocking wallets or sleeves can offer an additional defense layer by preventing unauthorized scanning.

Regular Monitoring of Accounts: Regularly check bank statements and account activity for unauthorized transactions. Set up alerts for real-time notifications whenever your card is used, which allows for quick reporting of suspicious activity

.

Report Losses Immediately: If your RFID credit card is lost or stolen, report it immediately to your bank to mitigate potential fraudulent transactions.

The Future of RFID in Credit Card Transactions

As technology continues to evolve, the role of RFID in credit cards will likely expand and enhance. The continued development of near-field communication (NFC) technology and improvements in encryption methods will further bolster the security and ease of transactions.

Additionally, as more retailers adopt contactless payment systems, customers will enjoy greater flexibility in how they choose to conduct their transactions. This trend will contribute to a more user-friendly shopping experience while also addressing security concerns associated with credit card usage.

Conclusion

RFID technology has revolutionized the landscape of credit card transactions, making them faster, easier, and more secure. The combination of convenience and robust security features makes RFID credit cards a favorable option for consumers seeking to enhance their payment processes. However, users must remain vigilant about potential security risks and take the necessary precautions to safeguard their financial information. As RFID technology advances, it promises to further transform how we interact with our financial systems, aligning perfectly with the demands of modern consumers.

By understanding and embracing the benefits of RFID credit cards, consumers can enjoy a protected and efficient method of managing their finances without compromising on security.

The following points summarize the key aspects discussed in this article:

RFID technology allows for contactless credit card payments.

Each transaction generates a unique code, ensuring security.

RFID cards can be used easily by tapping near a reader.

Regular monitoring and RFID-blocking products can enhance security.

Through continuous advancements and an ongoing focus on security, RFID technology is poised to reshape the future of transactional interactions in a digital age.

---

This article is crafted to provide informative content about RFID technology as it relates to credit cards. If you need further expansion or specific sections to be addressed differently, please feel free to let me know.

What are the main security features of RFID technology?

RFID technology incorporates several robust security features that help mitigate risks associated with data transmission and unauthorized access. This report details the main security features integral to RFID technology.

Data Protection Mechanisms

RFID systems often include various data protection measures designed to safeguard the information transmitted between tags and readers. These features help prevent unauthorized access, cloning, and data interception. For instance, the use of encryption standards, such as Advanced Encryption Standard (AES) or Public Key Infrastructure (PKI), ensures that data transmitted can only be decrypted by authorized parties. Some RFID tags implement a "kill" feature, which allows an authorized reader to permanently deactivate the tag, rendering it non-responsive and inaccessible.

Security Layers in RAIN RFID

RAIN RFID technology, specifically, employs multiple security layers to enhance data protection and user privacy. These include cryptographic authentication mechanisms, which verify that communication between the tag and the reader is secure, thereby preventing unauthorized access. Additionally, features like Impinj Protected Mode, which keeps the tag inactive until activated by a reader presenting a correct PIN, add another layer of security. These measures are crucial as RAIN RFID is extensively used in high-stakes environments, including asset tracking and access control.

Tag and Reader Security

The integrity of the entire RFID system relies not only on secured tags but also on the security of readers and backend systems. Ensuring that readers are secured against tampering, such as firmware attacks or unauthorized access attempts, is critical. Moreover, backend systems must follow best security practices to prevent potential breaches and maintain data integrity. The RAIN RFID industry continues to monitor threats and adapt security protocols accordingly, allowing for improvements as technology evolves.

User Awareness and Management

Effective RFID security also hinges on user awareness and management practices. Employing access controls, implementing strict monitoring systems, and training staff about potential security threats are vital steps for organizations using RFID. This proactive approach to security management helps identify and repel unauthorized access attempts before they can affect sensitive data.

Mitigation of Security Risks

Organizations can address various RFID-related security risks through multiple strategies. For instance, using RFID-blocking sleeves can prevent unauthorized access by ensuring that the RFID signal cannot be read without the user's consent. Additionally, updating firmware and ensuring the use of reputable RFID solutions provide further safeguards against potential vulnerabilities.

How does RFID technology compare to traditional payment methods?

RFID technology offers a distinct approach to payment systems compared to traditional payment methods such as credit and debit cards. Below is an in-depth comparison focusing on core functionalities, security mechanisms, and the advantages and challenges associated with each technology.

Overview of RFID Technology in Payments

RFID (Radio Frequency Identification) technology allows for contactless payments by utilizing radio waves to communicate between RFID tags embedded in payment cards and readers. This method enables users to make transactions simply by bringing their card close to a reader, significantly enhancing the speed and convenience of transactions. RFID payment systems can support various encryption and authentication mechanisms to secure payment information during transactions, thereby offering a secure environment for users.

Traditional Payment Methods: Credit and Debit Cards

Traditional payment methods, such as credit and debit cards, have been the standard for financial transactions for decades. Credit cards allow users to borrow funds up to a preset limit to make purchases, while debit cards directly withdraw funds from the user's checking account. The processing of these transactions involves multiple steps, including authorization from the card issuer and the merchant's banks, which can introduce delays compared to RFID transactions.

Security Comparisons

The security mechanisms employed in RFID payment systems primarily include encryption and access control methods. Although RFID technology is generally secure, it is still susceptible to specific vulnerabilities, such as eavesdropping or relay attacks where unauthorized parties intercept communication between the card and the reader. To mitigate these risks, strong authentication protocols and regular security audits are essential.

In contrast, traditional credit card payments face their own set of security challenges. Risks include credit card fraud, employee errors in handling card data, and outdated system software. Fraudulent activities can occur at various points, including during data transmission, when card information is stored improperly, or through physical skimming devices attached to point-of-sale (POS) systems. While credit cards offer greater consumer protection through regulations such as the Fair Credit Billing Act, their digital nature requires vigilance in preventing unauthorized access and ensuring secure storage of information.

Advantages of RFID Over Traditional Methods

RFID technology provides several advantages over traditional payment methods. The primary benefits include:

Speed: Transactions with RFID cards are typically faster since they do not require insertion or swiping, allowing for quick payments that reduce waiting times in queues.

Convenience: Users can make payments without physically interacting with the card reader, which is particularly beneficial in high-volume environments such as transit systems and retail stores.

Reduced Wear: RFID cards have fewer mechanical interactions, leading to less wear and tear on both the cards and the reader devices.

Challenges and Future Directions

Despite its advantages, RFID technology faces challenges, particularly regarding cybersecurity. As the adoption of RFID systems increases, so does the potential for cyber attacks aimed at exploiting vulnerabilities. It is crucial for organizations to implement robust cybersecurity measures, including encryption and regular security assessments.

Looking ahead, integrating advanced technologies such as blockchain for secure transactions and AI for fraud detection could further strengthen the security and functionality of RFID payment systems. As RFID technology continues to evolve, establishing consistent safety standards will be essential to ensure user trust and widespread adoption.

In conclusion, while RFID technology presents a transformative approach to payment systems with its speed and convenience, traditional credit and debit cards still play a significant role in the financial ecosystem. Ongoing enhancements in security measures and technological integration will be vital in addressing the challenges faced by both payment methods.

What are some common misconceptions about RFID credit cards?

RFID (Radio Frequency Identification) credit cards have gained popularity due to their convenience, but a number of misconceptions surround their security and functionality. Below are some common misconceptions about RFID credit cards:

Misconception 1: RFID Cards Are Easily Hacked

Many people believe that RFID cards can be easily hacked or skimmed by thieves using specialized devices from a distance. However, while RFID technology does have vulnerabilities, successful data theft requires the thief to be quite close, often within inches. The amount and type of data that can be obtained are also limited, as attackers typically only capture the card number and expiration date—not personal identification information needed for online transactions.

Misconception 2: All RFID Cards Are Vulnerable

Another misconception is that all RFID cards are the same and equally susceptible to skimming. In reality, RFID security varies based on the design and encryption protocols used in the specific card. Some RFID systems incorporate multiple layers of security, including mutual authentication and changing identification codes, which make it significantly harder for unauthorized access.

Misconception 3: RFID-Blocking Products Are Necessary

A common belief is that using RFID-blocking wallets or sleeves is critical to protect against theft. Experts argue that while such products can provide peace of mind, they are often unnecessary due to the low risk of RFID theft. Statistics indicate that the actual incidents of RFID fraud are minimal compared to traditional forms of identity theft.

Misconception 4: RFID Technology Is Not Secure

Some individuals think that RFID technology is inherently insecure. In fact, many RFID implementations use encryption and other security measures to protect data. This includes using encrypted tokens that are generated for each transaction, making them difficult to exploit. Additionally, advancements in RFID technology have incorporated stronger security features over time, further mitigating risks.

Misconception 5: RFID Cards Can Be Used Without Consent

There is a widespread notion that RFID-enabled cards can be read without the user's knowledge or consent. While RFID technology does allow for contactless transactions, authorized readers typically require the card to be very close to the reader, offering some control over the transaction process. Unauthorized RFID reads are highly impractical in real-world settings due to physical limitations and security controls.

In summary, while RFID technology is not without its fears and potential vulnerabilities, many misconceptions exaggerate the risks associated with RFID credit cards. Understanding the real capabilities of RFID technology and the protective measures in place can help consumers feel more confident in using these modern payment methods

Can you explain the tokenization process in more detail?

What future trends can we expect in RFID technology for payments?