RFID TECHNOLOGY CREDIT CARD WALLETS

Understanding RFID Technology

RFID, or Radio Frequency Identification, is a technology that allows credit cards equipped with RFID chips to communicate wirelessly with payment terminals. When you tap your card near a contactless reader, the RFID chip emits a signal containing important transaction information. This technology streamlines the payment process, enabling quicker transactions compared to traditional methods such as swiping or inserting a card.

Enhanced Security Features

RFID credit cards include significant security enhancements that help protect sensitive information. Each transaction generates a unique encrypted code, known as a token, which is valid only for that specific transaction. This one-time code reduces the risk of thieves using stolen information for fraudulent transactions, as even if a skimmer captures the data, it would have no value for future use.

Vulnerabilities and Risks

Despite the robust security features of RFID technology, there are still potential vulnerabilities to be aware of. Thieves can use RFID readers to capture data from a card if they come within proximity, typically within a few inches. However, the weak signal strength and the need for close range mitigate the risk of mass data theft; barriers, such as wallets or bags, can prevent readers from capturing any signal at all.

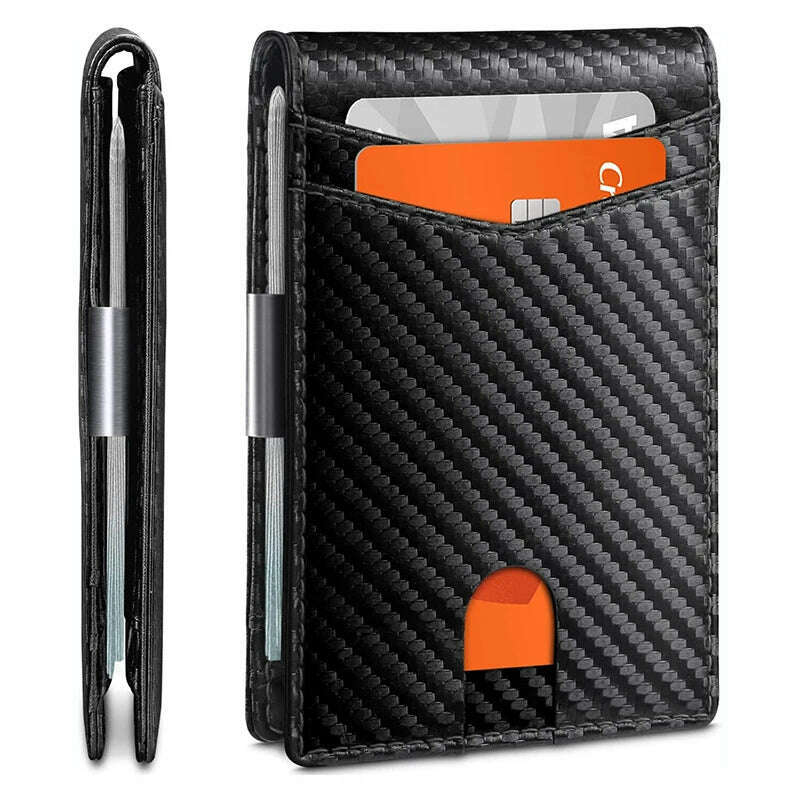

The Necessity of RFID Protection

While RFID credit cards are generally considered secure, some consumers opt for RFID-blocking products, such as wallets and sleeves, to add an extra layer of protection. Experts argue that while these items can provide peace of mind, they are often unnecessary for most users since standard wallets already provide adequate physical barriers against potential RFID skimming. Additionally, banks typically cover losses due to unauthorized transactions under their liability policies, which further reduces the need for such protection.

Conclusion

In summary, RFID technology significantly enhances the convenience and security of credit card transactions through unique encrypted codes and quick contactless payment options. Although some risks exist with RFID skimming, the security measures in place, such as one-time transaction codes and the minimal effective range for data capture, make RFID credit cards a safe option for most consumers today. Ultimately, while added protection can be beneficial, proper monitoring of accounts and following necessary precautions are the most effective ways to safeguard against credit card fraud.